On your stability sheet, you initially recognize prepaid promoting as an asset, and then you adjust it to the expense class during every period you receive the profit. Observe that in this example we established a short-term and long-term prepaid part as a outcome of the preliminary cost was for a two-year subscription. The long-term subscription pay as you go represents the worth of the subscription paid for upfront beyond 12 months and is amortized initially https://www.intuit-payroll.org/ of the subscription time period.

Let’s Discuss Merchandise Stock (no, Seriously)

Clear can also help you in getting your small business registered for Items & Providers Tax Regulation. Simply addContent your form 16, declare your deductions and get your acknowledgment quantity online. You can efile earnings tax return on your income from salary, house property, capital features, enterprise & profession and earnings from other sources.

Obtain free and customizable general ledger templates to streamline your accounting, observe payments, and manage your corporation funds effectively. Pay As You Go bills are classified as belongings as a result of they characterize cash that the company has not yet spent. Pay As You Go expenses—accounting’s little recreation where you spend money now, however we name it an “asset” till you truly use the factor you paid for. In the instance above, here is the impact of the pay as you go expense and their amortization within the Monetary Statements. With Out this process, paying $12,000 for annual hire in January would make that month look artificially expensive and the remaining eleven months artificially worthwhile. Proper documentation is crucial for audits and to show compliance with accounting standards.

Record Funds Accurately

Errors in recording or misclassifying property and expenses include severe risks. This creates points for budgeting and tax submitting, and may lead to poor enterprise decisions. Pay As You Go subscriptions for magazines, software program, or companies are quite common.

Pay As You Go bills are initially recorded as assets, as a end result of they’ve future economic benefits, and are expensed at the time when the advantages are realized (the matching principle). In the balance sheet, prepaid expenses are recorded as current property. Even although the company has made the cash transaction in the present monetary period, it’s unrelated to present expenses. The items or companies are then acknowledged as expenses as they are consumed or utilized over time, aligning with the matching principle of accounting. This course of ensures that expenses are recorded within the period during which they’re incurred, reflecting a more correct picture of a company’s financial place and efficiency.

In Rippling, you probably can handle expense reimbursements alongside vendor payments, payroll, and corporate cards on one intuitive platform. An ad-hoc expense administration system complicates your finance team’s capacity to gauge cash circulate and monitor prepaid expenses. Both ideas guarantee your monetary statements observe the matching precept, the place expenses are recorded in the identical period as the benefits obtained, no matter when cash truly changes arms. As the corporate realizes the benefits of the pay as you go expense, the value of the current asset decreases and transforms into a regular enterprise expense. The following prepaid expense entry instance outlines the most common pay as you go expense. It is impossible to supply a complete set of examples that tackle each variation in each state of affairs since there are hundreds of thousands of such bills.

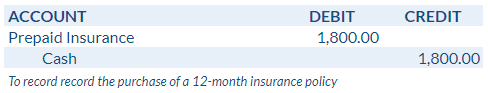

Prepaid bills come up when an organization pays upfront for goods or providers it’ll receive sooner or later. Common examples include rent, insurance coverage premiums, and legal retainers. Correctly recording these transactions is essential—overlooking or misclassifying prepaid bills can distort money circulate visibility and increase the risk of audits and compliance points. When you make a prepayment, it debits the prepaid expense account and credits the money account for the total amount in your stability sheet.

Understanding prepayments is crucial for correct financial reporting and decision-making. This article explores the definition, accounting treatment, and multiple examples of prepayments with solutions. These are the prices of goods or services that a company consumes earlier than it has to pay for them, such as utilities, rent, or payments to contractors or distributors. Accountants document these bills as a present legal responsibility on the stability sheet as they are accrued. As the corporate pays for them, they’re reported as expense gadgets on the earnings statement.

- And what’s the distinction between a prepaid expense and a regular expense?

- It is inconceivable to supply a complete set of examples that tackle each variation in every state of affairs since there are actually thousands of such bills.

- From a company’s point of view, a rise in prepaid expenses is a debit.

- Accrued bills don’t have any instant cash impact but create obligations for future funds while immediately affecting your revenue assertion.

- Pay As You Go bills seem as present assets as a end result of they represent future value you have already paid for, like prepaid rent or pay as you go insurance.

A pay as you go expense (also often recognized as prepayment) is a cost made upfront for an expense that hasn’t occurred yet. Assess the place you’re at and determine what would streamline your operations. From here, you presumably can standardize workpapers and begin to automate workflows.

For occasion, paying for a year-long software license prematurely often comes with a discount, but you sometimes can’t receive a refund should you stop using the service early. In many cases, access to the service continues until the tip of the paid time period, regardless of utilization. Understanding the cancellation and refund terms is essential when recording and managing prepaid assets. Many corporations pay employee medical health insurance premiums upfront, both quarterly or yearly. They will document the whole price as a prepaid asset on the stability sheet after which amortize it over the duration of the policy, normally on a month-to-month basis.